Frequently Asked Questions

- Why did I receive notice?

- What is the lawsuit about?

- Why is this a class action?

- Why is there a settlement?

- How do I know if I am part of the settlement?

- What does the settlement provide?

- What can I get from the settlement?

- What do I need to do to receive a payment from the settlement?

- When would I get my payment?

- What am I giving up to get a payment?

- How do I get out of the settlement?

- If I don’t exclude myself, can I sue later for the same thing?

- If I exclude myself, can I get money from this settlement?

- Do I have a lawyer in this case?

- How will the lawyers be paid?

- How do I tell the Court that I don’t like the settlement?

- What’s the difference between objecting and excluding?

- When and where will the Court decide whether to approve the settlement?

- Do I have to come to the hearing?

- May I speak at the hearing?

- What happens if I do nothing at all?

- Are there more details about the settlement?

- Why did I receive notice?

If you received a postcard or email notice relating to this case, then the records of Defendant show that you were assessed a Challenged Fee. Because of this, you are a member of at least one of the Settlement Classes, and you may be affected by this class action settlement.

“Challenged Fees” means APPSN Fees and Retry Fees. “APPSN Fee” means an Overdraft Fee that was charged (and not subsequently refunded) by Defendant from January 28, 2020 to November 30, 2022, inclusive, on a signature Point of Sale debit card transaction when the checking account had a positive available balance at the time the transaction was authorized but an insufficient available balance at the time the transaction was presented to Defendant for payment and posted to a member’s checking account. “Retry Fee” means an NSF Fee that was charged (and not subsequently refunded) by Defendant from January 1, 2015 to November 30, 2019, inclusive, for an ACH or check transaction that was resubmitted after previously being declined.

The Court is providing this notice because you have a right to know about the proposed class action settlement, and about your options, before the Court decides whether to approve the settlement. If you do nothing and the Court approves the settlement, and after any appeals are resolved, the benefits of the settlement will be provided to you.

This package explains the lawsuit, the settlement, your legal rights, what benefits are available, and how those benefits will be calculated.

Top

The Court in charge of the case is The Circuit Court of Montgomery, Alabama, and the case is known as Kendrick v. Guardian Credit Union. The people who sued are called the Plaintiffs, and the credit union sued is called the Defendant. - What is the lawsuit about?

The lawsuit claims that Defendant improperly assessed the fees. Defendant denies that it did anything wrong. Defendant claims that it was allowed to assess these fees, and properly did so in accordance with the terms of its account agreements and applicable law.

Top - Why is this a class action?

In a class action lawsuit, one or more people called “Class Representatives” (in this case Krystal Kendrick, Tawanda Fayson, Glenda Fayson, Eric Williams, and Jimmy Williams) sue on behalf of themselves and other people who have similar claims. All of these people are called a Class or Class Members. This is a class action because the Court has decided it meets the legal requirements to be a class action solely for the purposes of settlement and notice. Because the case is a class action, one court resolves the issues for everyone in the Classes, except for those people who choose to exclude themselves from the Classes.

Top - Why is there a settlement?

The Court did not decide in favor of the Plaintiffs or the Defendant. Instead, both sides agreed to a settlement. That way, they avoid the cost of a trial and the risks of either side losing, and they ensure that the people affected by the lawsuit receive compensation. Defendant does not in any way acknowledge, admit to or concede any of the allegations in the lawsuit and expressly disclaims and denies any and all fault or liability for the charges that have been alleged in this lawsuit. The parties think that the settlement is best for everyone involved under the circumstances. The Court will evaluate the settlement to determine whether it is fair, reasonable, and adequate before it approves the settlement.

Top - How do I know if I am part of the settlement?

If you received an email or postcard notice addressed to you, then you are a member of at least one of the Settlement Classes, you will be a part of the settlement, and the applicable benefits of the settlement will be provided to you, unless you exclude yourself. If you are not sure whether you have been properly included, you can call the settlement phone number at 1-866-464-4734 to check.

Top - What does the settlement provide?

The Defendant has agreed to pay $4,000,000.00 into a Settlement Fund to settle this case. As discussed separately below, attorneys’ fees, litigation costs, the costs of notice and the costs of distributing the settlement benefits, among other settlement administration costs, and service awards to the Class Representatives will also be paid out of the Settlement Fund. In addition to the Settlement Fund, the benefits of this settlement include: (a) Defendant will forgive any Challenged Fees that were assessed but were not paid because they were charged-off, in the amount of $402,551.00; and (b) within a commercially reasonable time, Defendant will cease charging APPSN Fees altogether.

Top - What can I get from the settlement?

After deducting the attorneys’ fees and expenses, costs of notice and administration, and service awards to the Class Representatives approved by the Court, there will be a Net Settlement Fund available for distribution to Class Members. Each Class Member will be paid from this fund on a pro rata basis, based on the amount of applicable Challenged Fees paid by the Class Member. For example, a Class Member who paid $1,000.00 in applicable fees will receive a check or account credit for twice as much as a Class Member who paid $500.00 in applicable fees.

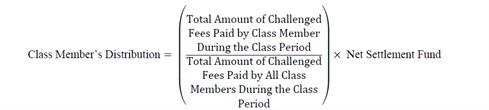

The actual amount of any Class Member’s check or account credit will be determined by an independent settlement administrator based on the following formula:

You will not receive more in the settlement than the amount of the applicable fees that you paid.

Top - What do I need to do to receive a payment from the settlement?

You do not need to do anything to receive a payment from the settlement or account credit or debt forgiveness. As long as you do not exclude yourself, you will receive a settlement payment, account credit, and/or debt forgiveness, if the settlement is approved and becomes final and if you are eligible. The additional benefits will also automatically be provided after the settlement becomes final. If your address changes, however, please call 1-866-464-4734 or send an email to [email protected] to report the address change so that your payment reaches you.

Top - When would I get my payment?

The Court will hold a hearing on June 25, 2024 at 9:30 A.M. to decide whether to approve the settlement. If the Court approves the settlement, there may be a period when appeals can be filed. Once any appeals are resolved or if no appeals are filed, it will be possible to distribute the funds. This may take several months and perhaps more than a year. You do not need to do anything to receive your payment.

Top - What am I giving up to get a payment?

Unless you exclude yourself, you are staying in the Classes, and that means you can’t sue, continue to sue, or be part of any other lawsuit against Defendant relating to the legal claims that were or could have been brought in this case. It also means that all of the Court’s orders will apply to you. Once the settlement is final, your claims relating to claims that were or could have been brought in this case will be released and forever barred.

Top - How do I get out of the settlement?

To exclude yourself from this settlement, you must send a letter by mail stating that you want to opt out or be excluded from Kendrick v. Guardian Credit Union. The letter must include your name, address, telephone number, and your signature. You must mail your exclusion request postmarked no later than May 9, 2024 to:

Kendrick v. Guardian Credit Union Exclusions

P.O. Box 301130

Los Angeles, CA 90030-1130

Top

You can’t exclude yourself on the phone or by email or by letter to a different address. If you ask to be excluded, you will not get any settlement payment or credit and you cannot object to the settlement. You will not be legally bound by anything that happens in this lawsuit. You may be able to sue (or continue to sue) the Defendant in the future. - If I don’t exclude myself, can I sue later for the same thing?

No. Unless you exclude yourself, you give up the right to sue the Defendant for the claims that this settlement resolves. If you have a pending lawsuit, speak to your lawyer in that suit immediately. You must exclude yourself from this settlement to continue your own lawsuit. Remember that the exclusion deadline is May 9, 2024.

Top - If I exclude myself, can I get money from this settlement?

No. If you exclude yourself, you are not eligible for any money or benefits from this settlement.

Top - Do I have a lawyer in this case?

The Court appointed Lynn A. Toops of Cohen & Malad, LLP; J. Gerard Stranch, IV of Stranch, Jennings & Garvey, PLLC; and F. Jerome Tapley of Cory Watson Attorneys to represent you and other Class Members. Together, the lawyers are called Class Counsel. You will not be charged for these lawyers. If you want to be represented by your own lawyer, you may hire one at your own expense.

Top - How will the lawyers be paid?

Class Counsel will ask the Court for attorneys’ fees and expenses of up to 1/3 of the Value of the Settlement to be paid from the Settlement Fund, plus reimbursement of expenses, and service awards to the Class Representatives of up to $5,000.00 each, to be paid from the Settlement Fund. The amount of the attorneys’ fees, expenses, and service awards must be approved by the Court.

Top - How do I tell the Court that I don’t like the settlement?

If you’re a Class Member, you can object to the settlement if you don’t like any part of it. You must state the reasons for your objection and include any evidence, briefs, motions or other materials you intend to offer in support of the objection. The Court will consider your views. To object, you must send a letter stating that you object to Kendrick v. Guardian Credit Union. You must include your name, address, telephone number, your signature, and the reasons you object to the settlement, along with any evidence or legal argument that supports your objection. You must mail the objection to the following address postmarked no later than May 9, 2024:

Kendrick v. Guardian Credit Union Objections

Top

P.O. Box 301130

Los Angeles, CA 90030-1130 - What’s the difference between objecting and excluding?

Objecting is simply telling the Court that you don’t like something about the settlement. You can object only if you stay in the Class. Excluding yourself is telling the Court that you don’t want to be part of the Class. If you exclude yourself, you have no basis to object because this case no longer affects you.

Top - When and where will the Court decide whether to approve the settlement?

The Court will hold a Final Approval Hearing on June 25, 2024 at 9:30 A.M. at the Circuit Court of Montgomery County, 251 S. Lawrence Street, Montgomery, Alabama 36104 or by telephonic or videoconference, which will be listed on the settlement website. At this hearing, the Court will consider whether the settlement is fair, reasonable, and adequate. If there are objections, the Court will consider them. The Court will listen to people who have asked to speak at the hearing and complied with question 20 below. The Court may also decide how much to pay Class Counsel. After the hearing, the Court will decide whether to approve the settlement. We do not know how long these decisions will take. You are not required to attend this hearing.

Top - Do I have to come to the hearing?

No. You are welcome to come at your own expense if you wish, but Class Counsel will answer questions the Court may have. If you send an objection, you don’t have to come to Court to talk about it. As long as you mailed your written objection on time, the Court will consider it. You may also pay your own lawyer to attend, but it’s not necessary.

Top - May I speak at the hearing?

You may ask the Court for permission to speak at the Final Approval Hearing. To do so, you must send a letter stating that it is your “Notice of Intention to Appear in Kendrick v. Guardian Credit Union.” You must include your name, address, telephone number, your signature, and any evidence you intend to use at the hearing. Your Notice of Intention must be postmarked no later than May 9, 2024, and be sent to the address listed under question 16. If you hire a lawyer to speak for you, he or she must also comply with the requirements of this paragraph and must file an appearance in accordance with the applicable rules of the Court.

Top - What happens if I do nothing at all?

If you do nothing, you will be a part of this settlement, and you will be provided the payments, account credit, and/or debt relief and any other benefits provided by the settlement once it becomes final. In exchange for the settlement benefits, you won’t be able to start a lawsuit, continue with a lawsuit, or be part of any other lawsuit against the Defendant relating to the claims released in the Settlement Agreement.

Top - Are there more details about the settlement?

This website and the notice summarizes the proposed settlement. More details, including the Settlement Agreement, are available on under the Case Documents tab. You can also call toll-free 1-866-464-4734. Be sure to state that you are calling about the Kendrick v. Guardian Credit Union settlement.

Top